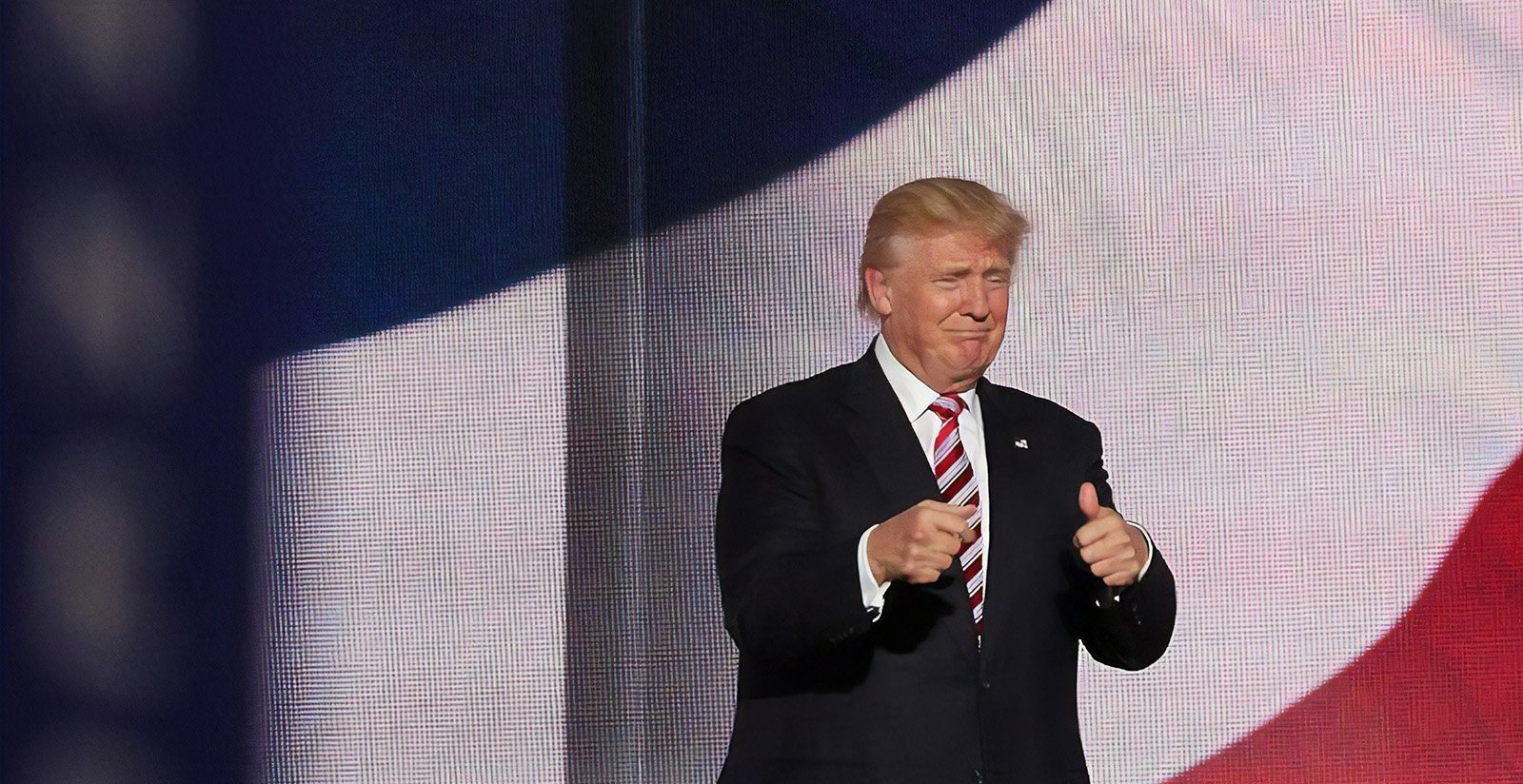

“Real power is, I don’t want to use the word, fear”, Donald Trump said in an interview in 2016.

Trump: The main risk to markets – and to himself

Since early 2018, fear has spread to financial markets – most of it due to higher political risk. If you measure “market fear” through equity volatility, it’s evident that uncertainty has been on the up over the past year.

The volatility in the MSCI World index over the past 52 weeks has been around 15%, while a year ago the previous 52 weeks showed only a level of about 10%. A major reason for the higher uncertainty in markets is the advance in global political risk – mostly driven by President Trump’s hawkish agenda.

Trade conflicts take a swing at global growth

A year ago, on March 1st 2018, the US announced that it will impose tariffs on steel and aluminium imports. This was a critical juncture in the trade relations between the US and the rest of the world.

Fast forward a year (after the first major tariffs), the global economy seems to be growing below trend growth and at one-fifth slower pace than during the first quarter of 2018. Much of this significant slowdown can be attributed to the trade dispute between the US and China.

Mr Dealbreaker

Early in the presidency, Trump introduced his “withdrawal doctrine” related to the America First policy, where he threatened to disengage USA from “unfair” accords – unless America got a better deal. Such foreign policy is a major threat for trade and hence global economic growth. Quite accurately, Sweden’s Carl Bildt pointed out that Trump would be known as the “Great Dealbreaker”.

Assessing Trump risk is a strenuous task. Besides trade disputes, it also includes government shutdowns, debt ceiling conflicts, the Mueller investigation as well as political debacles both within the US and abroad. The uncertainty related to these risks will persist as long as Trump remains the “Leader of The Free World”.

Economic policy risk has risen during Trump’s second year of presidency, as tariffs and trade disputes took a toll on economic growth around the world. Not surprisingly, the manufacturing sector has taken the brunt of this slowdown. So far, the impact on the US economy has been contained, due to the fiscal stimulus package, which Trump unorthodoxly introduced in a late cycle economy.

Recession risks on the rise

But some economists are already warning of a US growth slowdown during 2019. The risk of a recession is on the rise and will likely strike the US economy in 2020. Ironically, the tax cuts might have pushed the timing of the US recession from this year into next – just in time for the US presidential election!

“It’s the economy, stupid”, was a term coined in 1992 during the Clinton campaign, meaning that the health of the US economy is a determining factor in the outcome of the election. Unless Trump and his aides conceive this (astonishing, if they did not), there is certainly a case for a landslide loss for Trump’s second presidential campaign in 2020.

While the US economic expansion is turning 10 years this summer, the American economy is at risk of going off the rails and slipping into recession – if business and consumer sentiment continues to deteriorate.

Trump risk and markets

The good news is that Trump potentially realizes the risk of a late cycle economy. This would mean that the US President eventually steps down from his hawkish agenda (coming out as a winner by making “tremendous” trade deals), which again feeds the global economic cycle by improving business sentiment through a recovering trade. Furthermore, proposing a possible bipartisan infrastructure investment plan later is also possible, which could fuel the economy and kick the recession can down the road.

Undoubtedly, Trump has caused and will cause further tumult in markets over the next two years. A more vulnerable global economy will not only induce volatility spikes in markets, but also keep market risks at higher than average levels.

Ending on a more positive note, markets usually need a “wall of worry” to be able to climb higher, which we have already seen in early 2019.

Unless Trump builds too high a wall for markets.

Peter Lindahl, Senior Portfolio Manager, Member of Evli's Allocation Team