Movements on the fixed-income, equity and currency markets became more pronounced in January. The brisk climb of the equity markets in early January came to a standstill and then changed direction at the end of the month.

Movement on the capital markets

Movements on the fixed-income, equity and currency markets became more pronounced in January. The brisk climb of the equity markets in early January came to a standstill and then changed direction at the end of the month. Finnish equities finished up 2.2 percent in positive territory, European 2.0 percent and Nordic 1.4, measured in euros. Emerging market equities achieved the strongest performance and finished up 3.2 percent in positive territory.

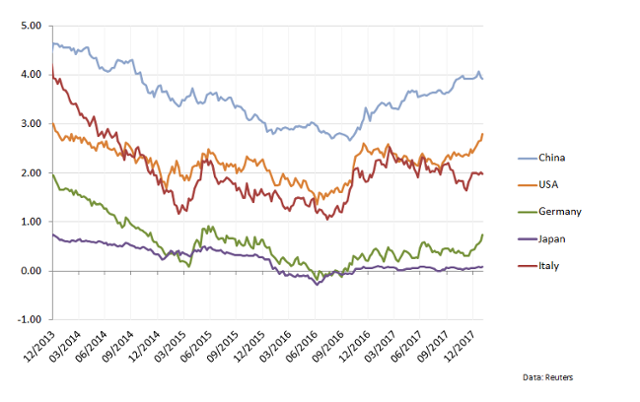

In the fixed-income market, the yield on Germany’s 10-year government bond rose 0.27 percentage points, finishing up at its highest level since 2015. The yield on the 2-year bond also climbed, finishing up at -0.53 percent.

The weakening of the dollar accelerated, and it declined against the euro by 3.5 percent in January. Last year, the euro strengthened by over 15 percent against the dollar, and the euro is now at its strongest since 2014. The weakening of the dollar has been broad-based, and the trade-weighted US dollar index has declined by over 10 percent.

Bitter cocktail on the fixed income markets

Many factors contributed to the rise on the fixed-income market, with the movement originating primarily from the US fixed-income markets. The crude oil price is on a clear rise, and as the barrel price nears 70 dollars it looks like the 50-dollar barrel price is a thing of the past. The rise in the crude oil price is increasing inflationary pressure, so the US central bank, the Fed, may decide to tighten its interest rate policy sooner than expected. In the USA, long-term interest rates were also raised by talk of China ending its US treasury bond purchases and by President Trump’s comments, which also contributed to the brief US government shutdown as the debt ceiling was reached.

In the equity markets, the financial results period got off to a promising start. It looks like profit performance at the end of last year will meet and even exceed market expectations. Clear growth can be seen in the dividends offered by Finnish listed companies in the spring.

Sound of political noise

In the UK, Prime Minister Theresa May’s position has weakened as the Brexit negotiations have become tougher. Last-minute solutions meant the first round of negotiations were completed in December, but since then, the bargaining positions have quickly become tougher. A government crisis in Britain would not make things any easier as the negotiations continue. The risk of a hard Brexit has increased.

In Germany, government negotiations narrowly avoided a dead end as the SDP agreed to join a coalition. However, the final composition of the government will only become clear later in the spring. A new partner in the government may affect Germany’s economic policy, especially as there is a clear surplus in the federal budget. In any case, Chancellor Merkel’s position is considered to have weakened.

It seems likely that the North American Free Trade Agreement (NAFTA) will be scrapped. Globally, international trade policy has entered a new phase, and new partners are being sought.

As Italy’s parliamentary elections approach, there is growing anticipation of political stalemate. There is huge support for the populist parties, but they are not expected to gain a sufficiently large majority. Depending on the viewpoint, in the best or worst case, Italy will gain a minority government. Italy’s economic growth has accelerated to about 1.5 percent, which is, however, at the lowest end of the scale in the euro area. Structural changes and stronger growth are still needed to solve the problems in the country’s economy. On the fixed income markets, Italy’s government bond yields have gone against the flow and yields have fallen.

Figure: 10 year rates have risen